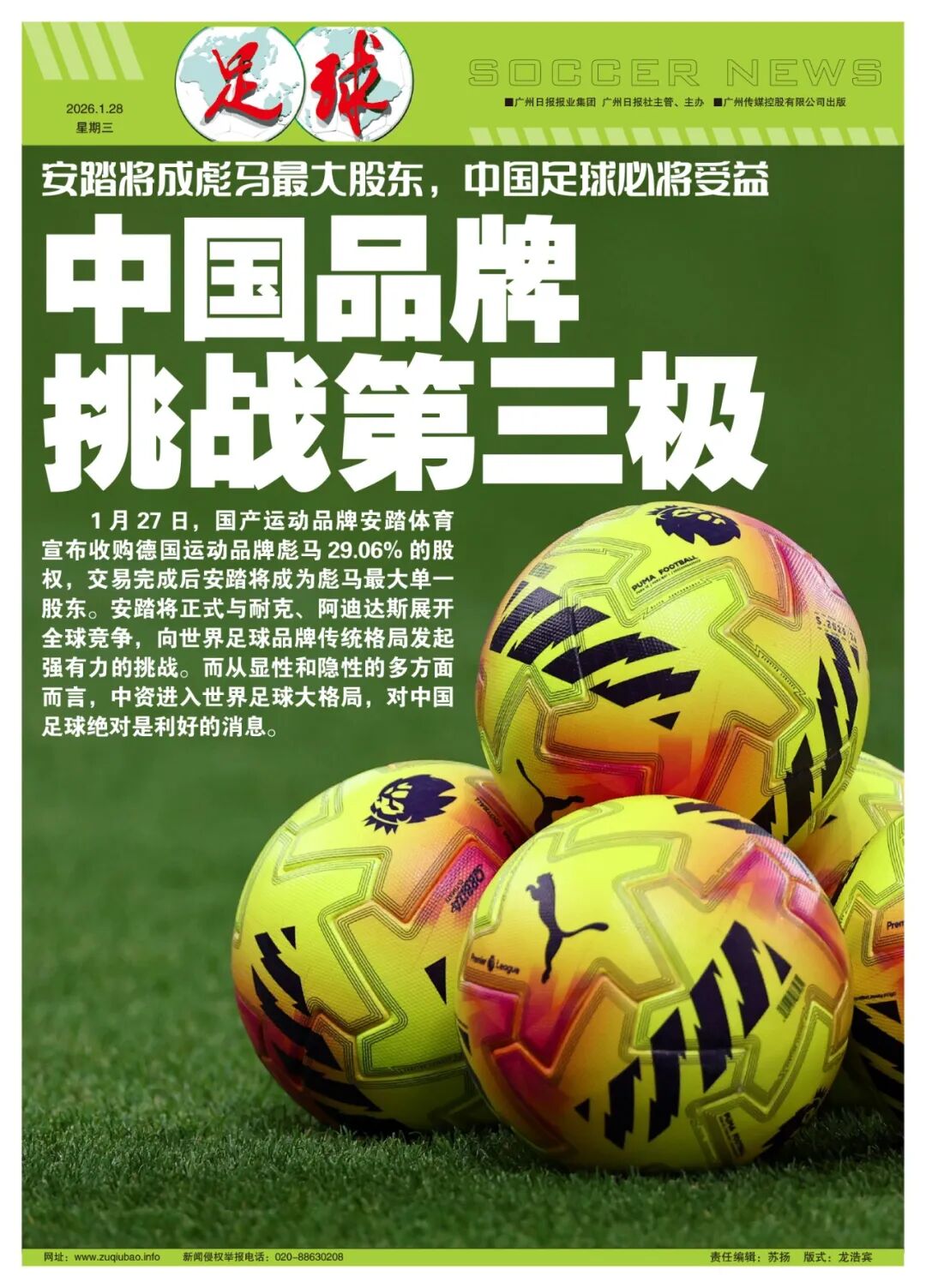

Anta Becomes Puma's Largest Shareholder, Will Chinese Football Benefit?

Written by Han Bing On January 27, Chinese sportswear brand Anta Sports declared its intention to purchase 29.06% of German brand Puma with €1.5 billion (around 12.28 billion RMB) in cash. After the deal closes, Anta will be Puma’s largest individual shareholder. This represents a landmark moment for Chinese sports brands expanding internationally. The acquisition, expected to complete by the end of 2026, will enable Anta to fully enter the global sports brand arena.

Anta’s annual revenue ranks third globally, behind only Nike and Adidas, but most of its sales come from the domestic market. Previously, Anta acquired international brands like Fila, Amer Sports, and Jack Wolfskin. Becoming Puma’s largest shareholder signifies that Anta’s global brand portfolio and full sports category layout are nearly complete. Anta is set to compete globally with Nike and Adidas, posing a strong challenge to the traditional football brand hierarchy. From both explicit and implicit perspectives, Chinese capital entering the global football landscape is undoubtedly positive news for Chinese football.

Rumors about Anta acquiring Puma shares circulated in the sports industry last August. Half a year later, the largest single international sports brand acquisition by Chinese capital has been finalized. In 2019, Anta led a consortium to acquire Amer Sports for €4.6 billion; the Finnish group owns brands like Arc'teryx, Salomon, and Wilson, but they are not top-tier in market share or recognition.

For Chinese sports brands expanding overseas and challenging the traditionally Western-dominated global market, acquiring an established global brand is a shortcut. Puma, currently the world’s third-ranked sports brand, is undoubtedly the ideal acquisition target.

The global sports brand market is dominated by Nike, Adidas, and Puma, which hold unmatched worldwide influence. Recently, Puma has aggressively expanded in football by sponsoring top clubs like Manchester City, Marseille, and AC Milan across five major leagues, as well as national teams from Italy, Portugal, and several African countries. This has disrupted the Nike-Adidas duopoly and established Puma as the legitimate "third pole" in global sports brands.

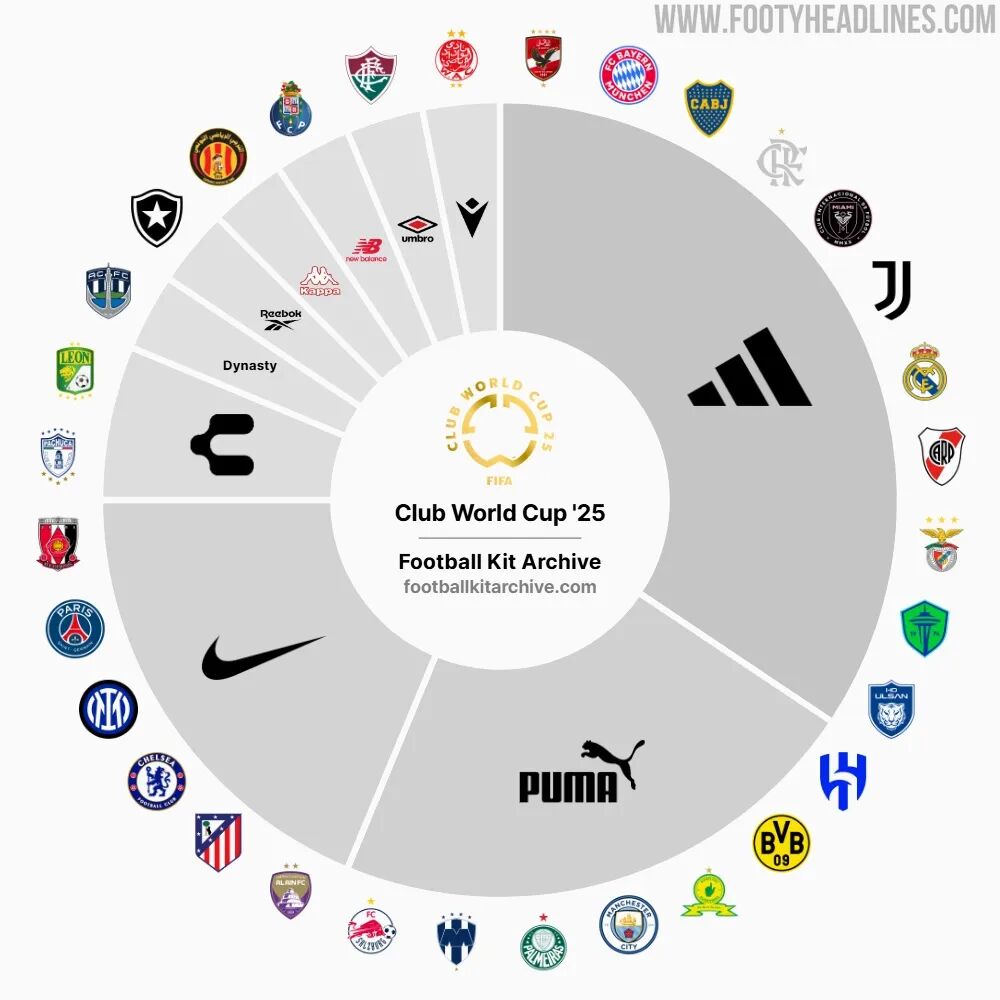

Although brands like New Balance, Under Armour, Macron, and Asics have grown rapidly and entered the football market, none have challenged Puma’s “third pole” status. At the 2025 Club World Cup, Adidas (11 teams), Puma (7 teams), and Nike (6 teams) will collectively sponsor 75% of the 32 participating teams, with the remaining 8 teams divided among 7 other brands.

For the 2026 World Cup, with 42 confirmed teams, Adidas (13 teams), Nike (11 teams), and Puma (10 teams) will sponsor 34 teams combined, accounting for 80% of the total, while the remaining 8 teams are sponsored by 8 different brands.

Compared to giants Nike and Adidas, Puma has smaller revenue but strong brand equity, a global marketing network, and sports resources, making it Anta’s preferred choice for rapid entry into the global sports market. Despite a crisis in 2025 with sales decline and a net loss exceeding €300 million, Puma’s brand value remains highly regarded in the industry, making this an ideal time for Anta’s acquisition.

Since acquiring Fila in 2009, Anta has pursued a diversified and global growth strategy. It has since acquired Descente, Kolon Sports, Amer Sports, and Jack Wolfskin, building a global brand portfolio spanning fashion sports, premium outdoor, and professional equipment. Becoming Puma’s largest shareholder fills gaps in football, motorsports, and street sports equipment, achieving Anta’s goal of a global, full-category competitive brand matrix.

Puma’s mature offline channels and brand influence in Europe, America, and Asia allow Anta to directly enter the market and become the new “third pole” of global sports brands. Puma currently sponsors the Premier League, La Liga, Serie A, Copa Libertadores, and Copa America, supporting 82 clubs across 26 countries on six continents, including Manchester City, AC Milan, Borussia Dortmund, Marseille, Valencia, RB Leipzig, PSV Eindhoven, Galatasaray, Fenerbahçe, Palmeiras, Al Hilal, Al Duhail, Pohang Steelers, and Kawasaki Frontale; as well as 16 national teams across five continents such as Portugal, Czech Republic, Austria, Switzerland, Egypt, Morocco, Ivory Coast, Senegal, Ghana, and Paraguay.

Although Puma will continue to operate independently in the short term, Anta as the largest shareholder can leverage Puma as a springboard to fully enter mainstream football, motorsports, and street sports markets in Europe and America, competing head-to-head with Nike and Adidas. This summer’s CONCACAF World Cup is undoubtedly the highest stage for Anta’s initial global sports brand entry. Previous acquisitions like Fila and Amer Sports successfully revitalized those brands and significantly boosted sales. Acquiring Puma not only lays the foundation for Chinese sports brands to fully enter the global market and challenge Nike and Adidas but also offers some possibilities for Chinese football’s international expansion.

The globalization of Chinese sports brands’ overseas expansion is intrinsically linked to the international development of Chinese football. As Chinese sports brands gain increasing global recognition and influence, Chinese sports, especially football, will undoubtedly benefit and receive greater acceptance in the global market.

Wonderfulshortvideo

The footwork, the finish 🤌

Did you get it? 🤔😅

The Wirtz x Sané link-up 🔗

Haaland’s movement 🥵

Which counterattack is

When you use your girlfriends shower 🚿 @Emily Bourne @LUSH

When Diogo Costa made himself a hero 🧤

Links

Links

Contact

Contact

App

App